Investing in the Philippines can seem daunting to beginners. But with the right mindset and a little bit of knowledge, investing can be a great way to secure your financial future. In this article, we’ll discuss how to start investing in the Philippines, from understanding the basics of investing to exploring the best investment options available. Whether you’re looking to grow your wealth, save for a specific goal, or simply learn more about investing, this guide will provide you with the tools and knowledge you need to get started.

Before Investing

- Set an Investment Goal

Setting an investment goal is an important first step to achieving financial success. To make one, you need to determine what you want to achieve and when you want to achieve it. Start by thinking about your financial needs and objectives, such as buying a house, saving for retirement, or paying off debt.

It’s important to be specific when selecting a goal. For example, if you plan to use your investment proceeds to buy a house, the price of the property will vary depending on where it is located and when you will buy it. A property in the Makati business district for example will generally be a lot more expensive than a similar one in Imus, Cavite. Once you’ve identified your goals, it will be easier for you to determine how much money you’ll need to achieve them.

The next step is to set a realistic timeline. It’s also important to consider your risk tolerance and investment options that align with your goals. By setting a clear investment goal, you can develop a plan that will help you make informed decisions about your investments and stay on track to achieve your financial goals.

- Choose an Investment Vehicle

An investment vehicle is a financial product or instrument that enables individuals or organizations to invest their money in order to generate returns. Stocks, mutual funds, MP2 Savings accounts, and ETFs are all examples of investment vehicles. There are hundreds, if not thousands of them, available for Filipinos to use to grow their “puhunan”.

We will discuss some of the most profitable vehicles below and on their individual pages on this website. For now, all you need to know is that these vehicles come with the promise of returns and risks.

The general rule is that returns are directly proportionate to the risks. The relationship between potential returns and potential risks in investments is known as the risk-return tradeoff. It states that the higher the potential returns an investment offers, the higher the potential risk involved.

If you prefer a low-risk investment (with a lower potential return) to park your money, you may want to look into high-interest savings accounts.

Now that we’ve established what the risk-return tradeoff is all about, you may want to assess your own risk appetite. Risk appetite refers to the level of risk you are willing to take on when making investment decisions. It reflects your willingness to accept uncertainty, volatility, and potential losses in pursuit of potential returns.

Now, let’s talk about some of the best investment vehicles that you can easily get into. When studying these investment vehicles, keep your investment goal and your risk appetite in mind.

- Create an Exit Plan

An exit strategy is a plan that an investor puts in place to sell their investments and exit a position. It is an essential part of any investment strategy as it allows investors to plan for the future and minimize losses.

An exit strategy helps investors make informed decisions by setting criteria for when to sell their investments. For example, an investor may decide to sell when a stock reaches a specific price or if the market conditions change.

Having an exit strategy is crucial as it helps investors to manage their risks, protect their profits, and avoid emotional decision-making. By knowing when to sell an investment, investors can avoid getting caught up in market fluctuations and make rational decisions based on their investment goals.

For example, when investing in the Pag-IBIG MP2, you have the option to reinvest dividends automatically or to start withdrawing them. An exit strategy would be to start withdrawing dividends when you reach a certain age so that you will start to enjoy the fruits of your investment. Another exit strategy would be to decide, at what age, you will stop investing in the Pag-IBIG MP2 program altogether. You could decide to take your capital out of the system at age 65 and the rest, another decade later.

This is just an example of an exit plan. Regardless of where you invest your money, you should create an exit strategy when you’ve reached your goal or if the market conditions change.

Best Investment Options in the Philippines

1. Pag-Ibig MP2

Pag-IBIG MP2 (Modified Pag-IBIG 2) is a voluntary savings program offered by the Philippine government Pag-IBIG Fund that offers higher dividends compared to the regular Pag-IBIG savings program, with a minimum investment period of five years.

Money in the Pag-IBIG MP2 savings program is primarily used to fund the agency’s housing programs, which include providing affordable housing loans to members. The Pag-IBIG Fund invests the MP2 savings in various income-generating projects, such as real estate ventures, government securities, and other low-risk investments.

In return, at least 70% of the profits generated from these investments are then distributed to MP2 members as dividends. Returns in the MP2 are tax-free and they can either be withdrawn annually or reinvested to take advantage of compounding interest.

Since its inception, the Pag-IBIG MP2 has consistently improved its performance with an average rate of return of 6.10%:

| Year | Dividend Yield |

| 2022 | 7.03% |

| 2021 | 6.00% |

| 2020 | 6.12% |

| 2019 | 7.23% |

| 2018 | 7.41% |

| 2017 | 8.11% |

| 2016 | 7.43% |

| 2015 | 5.34% |

| 2014 | 4.69% |

| 2013 | 4.58% |

| 2012 | 4.67% |

| 2011 | 4.63% |

| Average | 6.10% |

Risks: The MP2 is a professionally managed fund and it is a government-controlled corporation. The performance of the fund depends on the performance of its managers. Corruption, and mismanagement of funds are common in the Philippine government system. Only invest in the Pag-IBIG fund if you are comfortable with these risks.

FilipinoIncome.com Recommendation: The Pag-IBIG MP2 is one of the best investment options for the average Filipino. The barrier to entry is very small. You don’t have to be an expert to start making your investment grow. If you are comfortable with the risk stated above, you should consider putting a part of your portfolio into Pag-IBIG MP2 for long-term investments.

Here’s FAQs about the PAG-IBIG MP2

Steps for Investing in Pag-IBIG MP2

2. FMETF

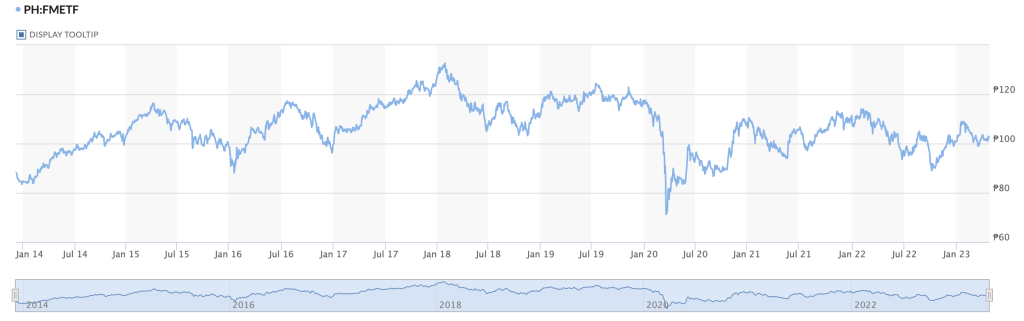

The FMETF is an exchange-traded fund (ETF) listed on the Philippine Stock Exchange (PSE) that aims to track the performance of the Philippine Stock Exchange Index (PSEi). The PSEi represents the top 30 publicly-listed companies in the Philippines.

The FMETF allows investors to gain exposure to the Philippine stock market in a cost-effective, diversified, and convenient manner, as it trades like a stock and can be bought or sold during trading hours.

How Do You Make Money?

Investors in FMETF can earn through capital appreciation (buying low and selling high). While the composite stocks give out dividends, these are already calculated into the trading price of the fund.

While the PSEi has been around for a long time, FMETF only opened its doors in the second half of 2013. Since then, the fund averaged a 3.09% with a high of 26.8% in 2014 and a low of -9.35% in 2015.

| Year | FMETF Performance |

| 2022 | -6.44% |

| 2021 | +11.58% |

| 2020 | -8.07% |

| 2019 | -8.40% |

| 2018 | -7.70% |

| 2017 | +21.94% |

| 2016 | +7.44% |

| 2015 | -9.35% |

| 2014 | +26.80% |

| Average | +3.09% |

Risks: The value of the FMETF’s underlying assets, which are stocks listed on the PSE, can fluctuate in response to market conditions and economic events. Factors like investor sentiments, political changes, or environmental events can lead to losses or gains in the FMETF’s value. Inflation, US and PH interest rates, USD-PHP exchange rates, and international fuel prices tend to affect the collective value of these companies.

FilipinoIncome.com Recommendation:

The FMETF is one of the best ways to get into stock investing for beginners because it gives you instant diversification. Compared to Pag-IBIG MP2, investing in FMETF comes with a higher risk and barrier to entry. It also requires a more hands-on approach.

Investors need to have a general familiarity with the volatility of the market and they to learn how to place bids to get into the position they want. Most importantly, investors in FMETF must be strategic in entering and exiting positions to maximize returns.

More About Index Investing in the Philippines (PSE)

3. REIT Investing

A REIT is a company that owns and manages real estate properties, such as apartments, shopping centers, and offices, to generate income. It allows investors to invest in real estate without the hassle of owning, managing, or financing properties themselves. REITs are relatively new in the Philippines, with the earliest REIT IPO (Ayala Land-sponsored AREIT) in 2020.

In the Philippines, REIT shares can be bought and sold on the PSE. They are required by law to give out at least 90% of their distributable income as dividends.

As of the writing of this article, there are 7 REITs:

- Ayala Land REIT (AREIT)

- Robinsons Land REIT (RCR)

- Double Dragon REIT (DDMPR)

- Filinvest REIT (FILRT)

- Megaworld (MREIT)

- Citicore Energy REIT (CREIT)

- VistaREIT (VREIT)

How do you make money?

Because REITs are exchange-traded, there is the potential for capital appreciation if you bought the shares at a lower price than your selling price. Profit-making REITs also give out quarterly dividends. This means that you will get four dividend payouts per year.

For example, if you invested PHP 100,000 in AREIT, the longest-running REIT in the country, by April 27, 2023 (the writing of this article), your investment could have a total paper gain (cash dividends + capital appreciation) of 17.21% per year. Your PHP100K could have a pre-tax value of PHP151k. This ROI however, should be taken with a grain of salt because not all REITs are created equal. Read the risks below.

Risk: The potential investment performance of REITs depends on the business performance of the properties in their basket. Office renters may transfer locations to competitors. Business owners may end leases. These events may affect the income of REIT properties and thereby affect the distributable income of the REIT. This may impact the dividend payouts of the company.

As with all exchange-traded assets, a REIT’s price, and value may be affected by market conditions. The price of REIT stocks is constantly fluctuating. For instance, the other seven REITs in the list above have all lost value since their IPO as of April 2023.

FilipinoIncome.com Recommendation:

REIT investing is not for beginners. It is similar to investing in individual stocks. Investors who venture into these companies need to be well-versed in the business of real estate rentals. It also helps if you have direct access to the properties of the REITs.

REITs work well as diversification instruments as long as you get them at the right price. Consider the Dividend Yield when buying them. Also, take into consideration that most of the properties in these REITs do not include the land they stand in. If the REIT only owns the building and not the land, the book value and the price of the company may not go up over time.

4. Investing in Company Stocks

If you have more experience in studying the market, you may consider investing in individual company stocks on the PSE. Investing in Philippine stocks involves buying ownership shares in a publicly-traded company through the PSEI. Owning shares make you a shareholder of that company. As a shareholder, you have a stake in the company’s assets and earnings, and you may receive dividends if the company distributes profits.

The value of your investment in the stock market fluctuates based on supply and demand, company performance, and other factors. Aside from dividends, you can also make money through capital appreciation if you buy the stocks of a company and then sell them a few years later after a period of growth. Growth can happen when a company expands its business operations or if it invests in research and development to discover innovations in its industry.

Risk: Investing in stocks is generally considered a risky investment because it requires skills like fundamental and technical analysis. These skills require practice and less experienced investors may lose money if they make the wrong financial decision.

Stock investing is also less diversified compared to investing in the FMETF (index investing) for example. By buying stocks of a company, your money is exposed to market risks as well as industry and company-specific risks. It’s best to only invest in stocks of companies that you know and to do you due diligence before buying.

Regardless of what you’ve heard, success investing is dependent on when you buy and sell your stocks. Just like any exchange traded assets, you need to learn to sell your investment when they are overvalued to maximize your profits. This requires a more active involvement in the market.

Lastly, you will often see pump-and-dump schemes in the Philippine stock market. A pump and dump scheme is a type of investment scam where fraudsters promote a stock to artificially inflate its price, creating a “pump.” The fraudsters then sell their shares at the inflated price, causing the stock price to drop, or “dump,” leaving other investors with losses. While there are no scam call centers in the Philippines promoting stocks as we see in the US, fraudsters in the Philippines often use manic buying events to inflate stock prices and use the FOMO of beginner investors. Beginners should be careful when buying into “trending” stocks without doing their due diligence.

Popular Investment Options to Avoid

1. Variable Universal Life Insurance

Variable Universal Life Insurance (VUL) is a type of life insurance that combines a death benefit with an investment component. The investment component allows policyholders to allocate their premiums into different investment funds, such as stocks and bonds.

Risks: One reason why VULs are considered a horrible investment is because of the high fees associated with them. VULs typically have high policy fees, mortality and expense charges, and investment management fees, which can significantly reduce the returns on investment.

Another reason is that the investment component of VULs is often complex and risky, making it difficult for policyholders to understand and manage their investments effectively. The investment funds offered by VULs may have high management fees and sales charges, and they may also have limited investment options.

Additionally, VULs can have high surrender charges, which can discourage policyholders from canceling their policies, even if they are not performing well.

Overall, VULs may not be suitable for everyone as an investment option. It is essential to consider all the fees and charges associated with VULs and to consult a financial advisor before making any investment decisions.

FilipinoIncome.com Recommendations:

Here at FilipinoIncome.com, we recommend all breadwinners buy life insurance to protect the financial future of their loved ones. Instead of getting VUL, term life insurance is a better option. It offers coverage for a specified period, and premiums are typically lower than VUL.

If you are in the market for both life insurance and investing options, you may consider buying separate investment and insurance products instead of combining them. They can purchase a term life insurance policy for protection and invest in other investment products like Pag-IBIG MP2, index funds, stocks, or bonds to meet their investment goals.

2. High-Management Fee Mutual Funds and UITFs

Mutual funds are a type of investment that pools money from different investors and invests it in various securities like stocks, bonds, and money market instruments. You can invest in them through investment companies like Sun Life and Manulife. You may need to work with their independent mutual fund representatives to have access to their mutual funds.

Unit Investment Trust Funds (UITF) are similar to mutual funds but they are offered by banks. Just like mutual funds, they pool money from investors and invest them in investment instruments. To invest in UITFs, you may check out some of the biggest banks in the country to learn about their UITF offerings.

Mutual funds and UITFs were traditionally sold through representatives of investment companies or banks. Recently, these investment companies have partnered with institutions like COL Financial for buying and selling shares.

Risks: Mutual funds and UITFs invest in different securities like stocks and bonds, which are subject to market risks. These risks arise from changes in the value of the underlying assets and market conditions, and they can cause the fund’s value to fluctuate.

The fund’s performance depends on the expertise of the fund manager. If the manager’s investment decisions do not perform well, the fund’s value may decline.

Mutual funds and UITFs charge fees and expenses for managing the fund, which can reduce the returns on investment. Traditional UITFs and Mutual Funds had management fees ranging from 2%-2.5%. This management fee is deducted from the fund value regardless if the fund is profitable or not.

Newer funds may have lower fees because of the competition from index funds. Good index funds have management fees ranging from 0.5%-1%.

FilipinoIncome.com Recommendation: Generally, we do not recommend mutual funds and UITFs because of the the awful (and borderline illegal) sales practices of the people selling them. In most asset management companies in the Philippines, the people selling mutual funds are also selling insurance products. If you go to these people, they will often convince you through aggressive selling tactics to buy insurance products (VUL) instead because these products have a higher commission rate. Don’t fall for this trap.